Subsidiary acquisition by a subsidiary company of Mimaki and the change in that company’s corporate name

Nagano, Japan, October 19, 2016

MIMAKI EUROPE B.V. (President and Representative Director Koji Shimizu), a consolidated subsidiary of Mimaki, in accordance with the “Announcement on the Share Transfer Agreement Regarding the Stock Acquisition of Italy’s La Meccanica” disclosed on June 10, 2016, announces that on October 18, 2016 (local time), it acquired all stock shares for Italy’s “La Meccanica Costruzione Tessili-S.P.A.” and converted it to a subsidiary company.

In addition, as of the date the stock acquisition closed, the corporate name of the company has been changed from “La Meccanica Costruzione Tessili-S.P.A.” to “Mimaki La Meccanica S.p.A.” and three of Mimaki’s executives will be appointed as directors. Moving forward, Mimaki will leverage La Meccanica’s product and technological expertise to accelerate its efforts to promote digital on-demand production in the textile apparel market on a global scale.

Subsidiary company overview

| Corporate name | Mimaki La Meccanica S.p.A |

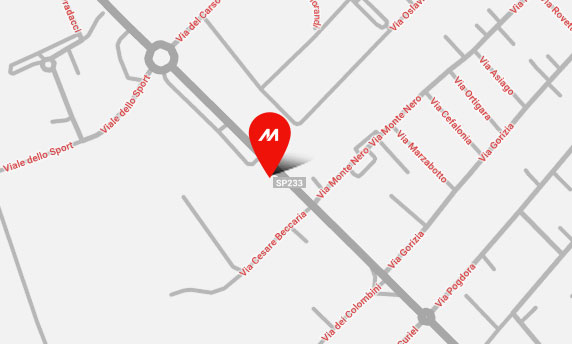

| Location | Via Delle Industrie 174CAP24059 Urgnano (Bergamo) Italia |

| Representative | Kazuyuki Takeuchi (Managing Director of Mimaki) |

| Business description | Production, sales and customer service for digital printing devices Textile inspections and production, sales and customer service for packaging machinery |

| Established | 1977 |

| Capital | €517,000 |

Future Outlook

“We are pleased to bring La Meccanica’s talented people and advanced technology under the Mimaki umbrella,” said Kazuaki Ikeda, President. “La Meccanica has a great reputation in the textile industry, and this acquisition bolsters Mimaki’s efforts to bring the digital transformation to textile printing. The acquisition of La Meccanica is not expected to have any significant impact on Mimaki’s consolidated performance for the current fiscal term, and thus, there will be no revisions to Mimaki’s earnings forecast as a result of this acquisition.”